Are you looking for 'condo assignment hst'? You will find all the information on this section.

HST: HST in condominium assignment sales is a point of stress for letter a lot of buyers and sellers. HST rebates are purchasable for both end-users and investors, just an assignment cut-rate sale might make end-users ineligible for the rebate.

Table of contents

- Condo assignment hst in 2021

- Assignment sale hst

- Who pays assignment fees

- Hst on pre construction

- Assignment sale tax implications

- What is a condo assignment

- Buy condo assignment toronto

- Assignment property

Condo assignment hst in 2021

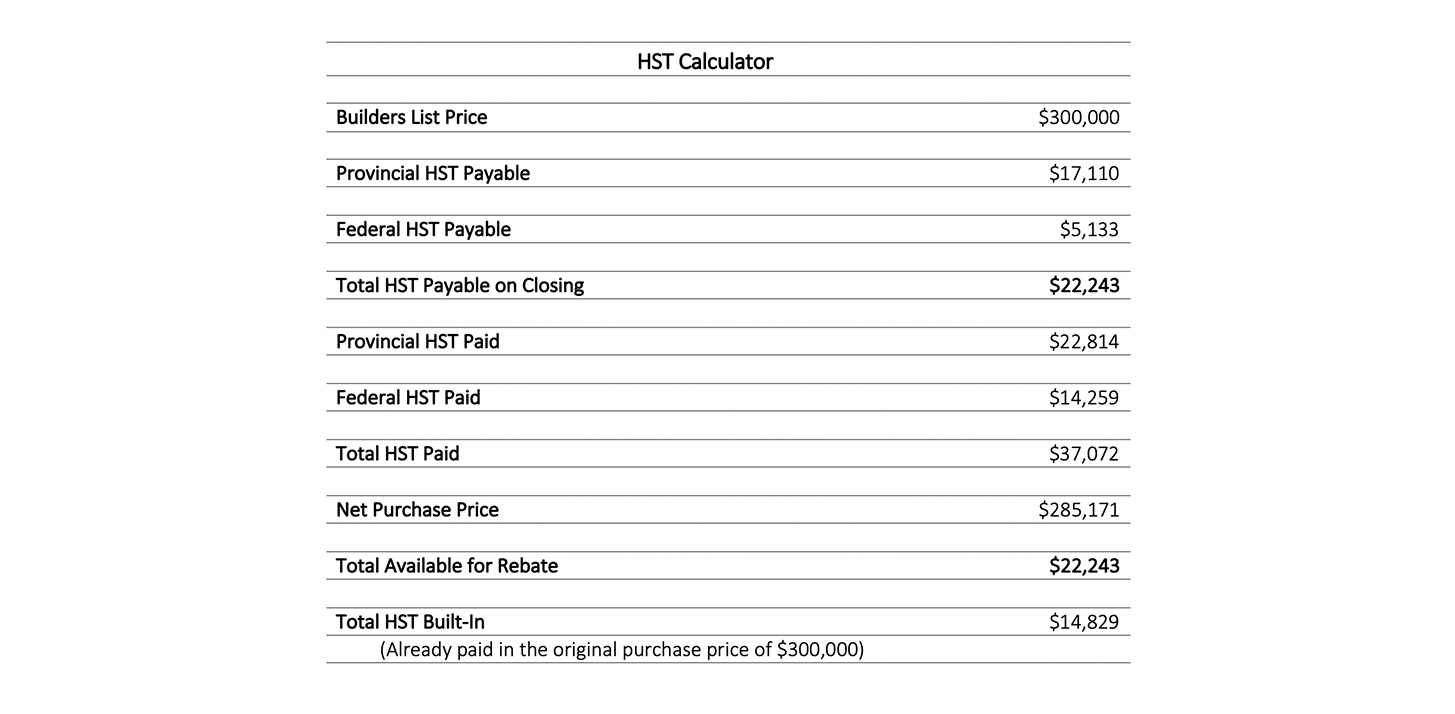

This picture illustrates condo assignment hst.

This picture illustrates condo assignment hst.

Assignment sale hst

.jpg) This picture representes Assignment sale hst.

This picture representes Assignment sale hst.

Who pays assignment fees

This image shows Who pays assignment fees.

This image shows Who pays assignment fees.

Hst on pre construction

This image demonstrates Hst on pre construction.

This image demonstrates Hst on pre construction.

Assignment sale tax implications

This image illustrates Assignment sale tax implications.

This image illustrates Assignment sale tax implications.

What is a condo assignment

This picture demonstrates What is a condo assignment.

This picture demonstrates What is a condo assignment.

Buy condo assignment toronto

This image representes Buy condo assignment toronto.

This image representes Buy condo assignment toronto.

Assignment property

This image illustrates Assignment property.

This image illustrates Assignment property.

When to use GST and HST for new house?

This info sheet explains how the GST/HST applies to the assignment of a purchase and sale agreement for the construction and sale of a new house. The term "new house" used in this info sheet refers to a newly constructed or substantially renovated house or condominium unit.

How is GST paid on assignment of property?

GST/HST is payable by the assignee on the assignment fee and the amount attributable to the deposit that was paid by the assignor to the builder of the property the assignee is eligible to claim the GST/HST new housing rebate the new housing rebate can be assigned to the builder and credited against the purchase price

Do you pay HST on an assignment sale?

HST is payable on an assignment sale of an Agreement of Purchase and Sale (“APS”). Remember when you do an assignment you are not selling the house or property you are selling your APS. The issue is what you pay the HST on, who pays it and how much that will be. Generally the HST will be in addition to the price and paid for by the buyer.

What are the costs of buying a condo on assignment?

When buying a condo on assignment sale, you will be responsible for closing costs once the builder registers the building. These costs include Land Transfer Tax, Utility Connection Fees, Development Charges, etc. [1] However, you are exempted from HST if you plan on using your condo as your primary residence.

Last Update: Oct 2021