Do you scour the internet for 'event study thesis'? All the details can be found here.

Table of contents

- Event study thesis in 2021

- Clustering event study

- Event study stata

- Event study lecture notes

- How to conduct an event study

- Market adjusted model event study

- Sample thesis topics in education

- Copy of a thesis paper

Event study thesis in 2021

This image illustrates event study thesis.

This image illustrates event study thesis.

Clustering event study

This image representes Clustering event study.

This image representes Clustering event study.

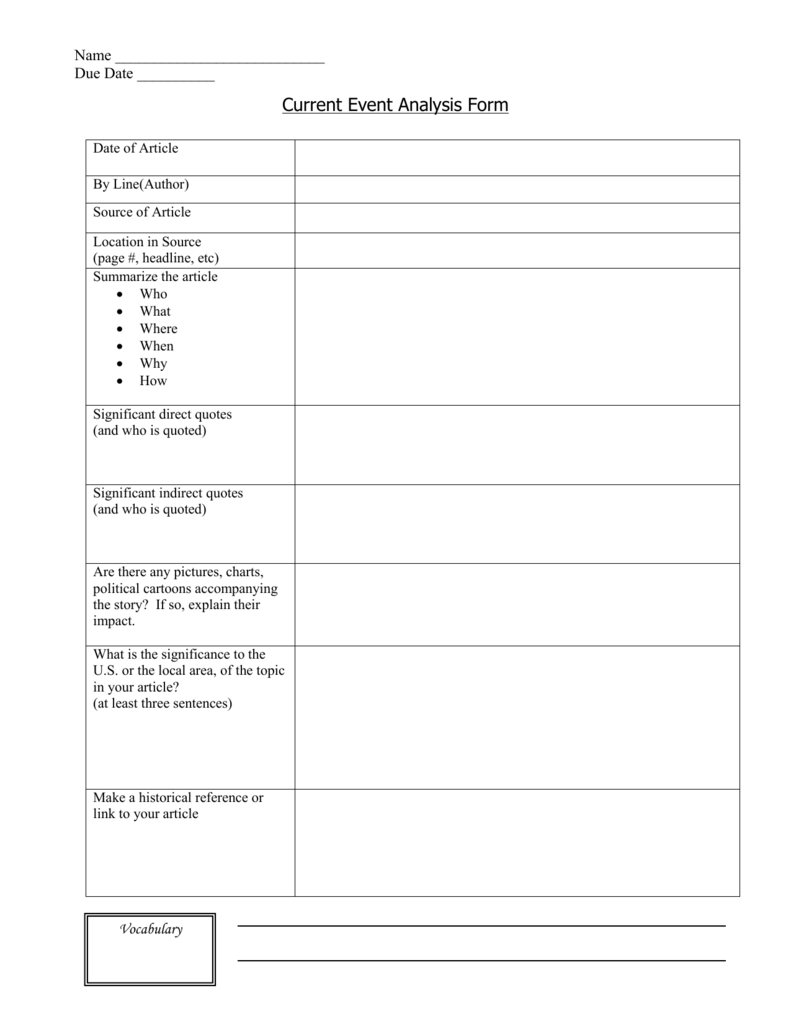

Event study stata

This image illustrates Event study stata.

This image illustrates Event study stata.

Event study lecture notes

This picture shows Event study lecture notes.

This picture shows Event study lecture notes.

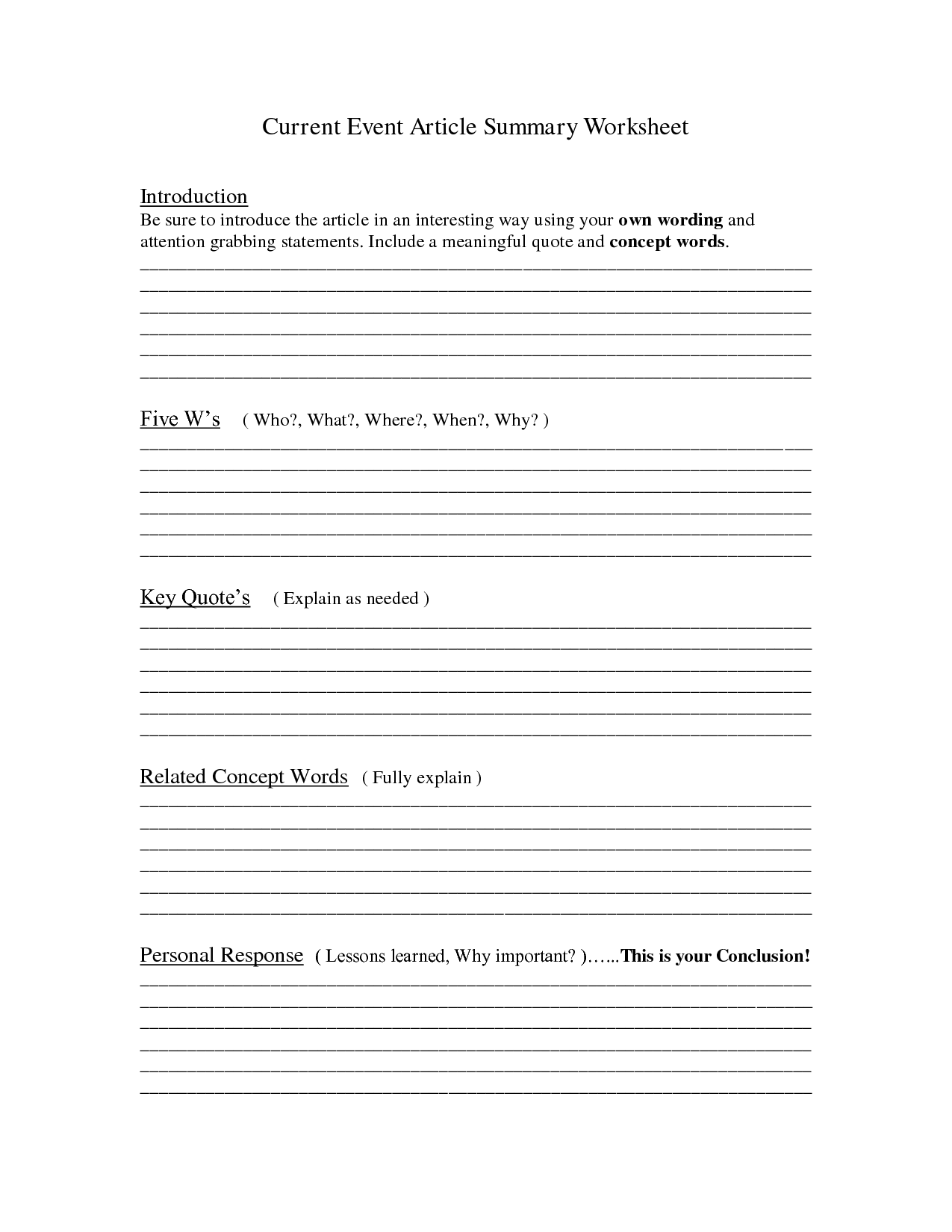

How to conduct an event study

This picture illustrates How to conduct an event study.

This picture illustrates How to conduct an event study.

Market adjusted model event study

This picture representes Market adjusted model event study.

This picture representes Market adjusted model event study.

Sample thesis topics in education

This image representes Sample thesis topics in education.

This image representes Sample thesis topics in education.

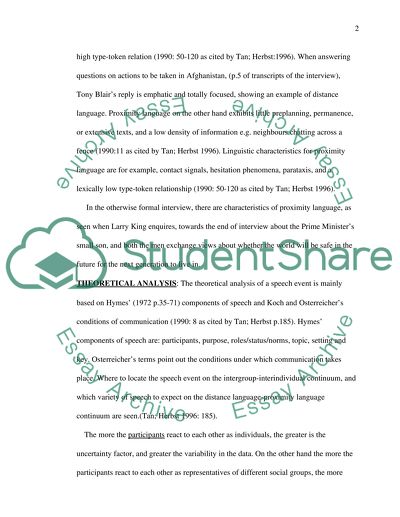

Copy of a thesis paper

This picture illustrates Copy of a thesis paper.

This picture illustrates Copy of a thesis paper.

How are return event studies used in finance?

Finance scholars have developed the event study methodology to perform this type of analysis - in its most common form, with a focus on stock returns, in less used forms, with a focus on trading volumes and volatilities. Return event studies quantify an event's economic impact in so-called abnormal returns.

What is the methodology of an event study?

Finance scholars have developed the 'event study methodology' to perform this type of analysis - in its most common form, with a focus on stock returns, in less used forms, with a focus on trading volumes and volatilities. Return event studies quantify an events economic impact in so-called abnormal returns.

How are CAARS calculated in an event study?

In a sample event study that holds multiple observations of individual event types (e.g., acquisitions), one can further calculate cumulative average abnormal returns (CAARs), which represent the mean values of identical events.

How is the impact of an event measured?

To measure the total impact of an event over a particular time period (termed the event window), one can add up individual abnormal returns to create a cumulative abnormal return. Equation (2) formally shows this practice. The most common event window found in studies is a three-day event window starting at t 1 = − 1 and ending at t 2 = 1.

Last Update: Oct 2021